Bonhams Head of Books Matthew Haley on Investing in Rare Books

A Shakespeare First Folio that in 1623 cost the equivalent of 44 loaves of bread would, if sold today, buy up to five million loaves—enough to give every man, woman and child in the UK a slice of toast each.

This startling claim will be made by Bonhams Head of Books Matthew Haley when he speaks at the Hay Festival on Thursday 29 May. Taking as a base the copy of the First Folio bought in 1623 by Sir Edward Dering for the equivalent of £44 in today’s currency, he traces the inexorable rise in value of this most famous of rare books through 105 loaves in 1756 to 900 at the end of the 18th century to a massive two to five million loaves today.

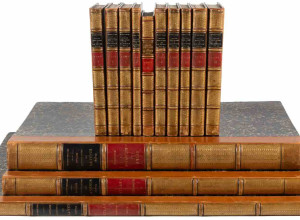

The talk entitled ‘Tomorrow’s treasures: are rare books a good investment?’ will offer a wide historical look at the question of investing in rare books over the centuries and delve into the world of great book collections and collectors of the past. Richard Heber, for example, the son of a wealthy rector at the end of the 18th century, who at his death in 1833 owned eight houses crammed with books, was so absorbed with his passion that even at the age of 12 was causing his father to write to his sister, “Tell Dicky. I will have no more debts contracted with booksellers.” As Haley puts it, “This is the 18th century equivalent of running up your Dad’s credit card bill. Some things clearly never change.”

A handful of rare books are so scarce and so valuable that their appeal and financial value will never diminish says Haley. The Gutenberg Bible and the Shakespeare First Folio are the best known examples but there is continued demand for first editions of iconic books by iconic writers from any era. Picking the stars of the future from today’s crop of writers, however, is always going to be more difficult, he says—how many other books from 1623 are household names?—but most collectors also buy books for the pleasure they bring. As Matthew Haley says, ”An investment in rare books is an investment in your brain as much as in your portfolio.”